Menu

Is Technology Making Tax Less Taxing?

There are not many people in the UK who spin cartwheels or become overjoyed with excitement at the thought of tax. Its understandable really, the mere mention of the word tax is a party stopper. When we think of tax, we usual visualise the macabre, gray depressing things that hunt at the edges of our mind, tax is not a nice word. Tax is however a subject that we all need to get to grips with. Like it or not, the chances are that if you work in the UK, you will have to pay tax. Even the 2-faced comedians out there who joked of tax avoidance and criticized others of avoiding tax, only later to be exposed as a tax avoider eventually have to pay the tax man. The UK is getting tough on tax and rightly so, it's time for the tax avoiders and tax rule benders to play the straight game. Tax has become a hot topic, we all know the stories outlined above and we are all annoyed at the injustice but we have to trust that HMRC has the tax dodgers in their firing line. What is important to us, the common tax payer, is that we pay the right tax and have access to tax rebates when they are due.

This article is an unorthodox introduction to self assessment tax, the aim of this article is to encourage you to think about your tax circumstances and ask yourself, could I claim a tax return? Could I pay less tax if I completed a self assessment tax return. For those intelligent enough to use iCalculator to review their salary and tax arrangements, for those sensible enough to review this article, the answer is that yes, you are likely to be due a tax return if you review your personally funded work related expenditures. You may not need to complete a self assessment tax return, a form P87 provides sufficient information for an employee to claim for expenses incurred as part of business activity.

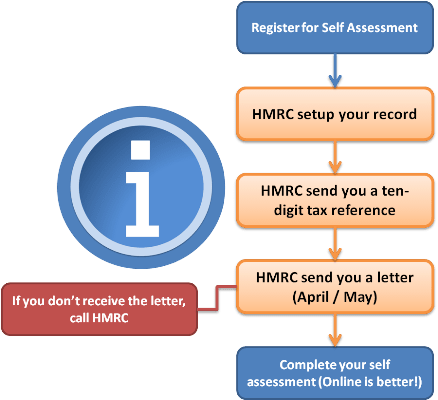

So, will you file a self assessment tax return this year? Maybe not but we hope you will at least file a P87 and claim back the money you are due. For those that do file their self assessment tax return, GO ONLINE. HMRC's new tax systems received heavy criticism when first launched and were very buggy but they have listened, learned and improved. Overall, the online tax portals provided by HMRC now are very slick and provide returns calculation far quicker than the traditional paper return.

Has tax become less taxing? We think so but ultimately it is you that must put the systems to the test. There is no point moaning and groaning about those who don't pay their tax, the trick is to claim back the tax relief you are due and force the government and HMRC to address those who avoid tax. There are around 33 million working people in the UK, if we all claimed just £100 in tax relief.... It's fair to assume that there would be less comedians having a laugh at the expense of the rest of us. If that's not food for thought, think of £100 times 40 years of work, there aren't many that would turn down a £4k retirement fund.

There is further information below on Self assessment tax returns and P87 Tax Relief for Expenses of Employment. We hope you find this tax article useful, if you do please share on your favourite social network. Have something to add, drop us a line.

What is a Self Assessment Tax Return?

Self Assessment is the simple process of completing a tax return each year that shows all your income and expenditures liable for tax relief. Most people file self assessment tax returns as it enables them claim tax allowances or reliefs on your tax return. Most people who work would pay less tax if they completed a self assessment tax return but the tax relief may not warrant the time it takes to complete the return.

Who needs to complete a Self Assessment tax return?

Surprisingly, not everyone in the UK has to complete a self assessment tax form. The UK, unlike other countries does not mandate a self assessment tax return as long as your tax affairs are straightforward. HMRC don't of course specific what they interpret as straightforward but it is fair to assume that this includes regular PAYE employees without secondary income etc, Pensioners and those on benefits. This doesn't mean you shouldn't consider a self assessment tax return.

- Do you have special clothing or equipment that you provide yourself for work?

- Do you provide your own stationary?

- Do you work from home sometimes using your own electricity and a percentage of your house?

- These are all areas which could mean tax relief (or a tax rebate cheque in the post to the average Jo).

Those who must file self assessment include:

- The self-employed

- Company Directors

- Trustees

- Individuals in receipt of foreign income

What information do I need to register for a Self Assessment Tax Return?

- Your National Insurance number. IF you don't have a National Insurance Number (your first time working in the UK etc) you should first apply for a national insurance number at the following page on HMRCs website - http://www.hmrc.gov.uk/ni/intro/number.htm

- Your contact details (Address, telephone, mobile and email)

- If you are self employed, the contact details of your business (Address, telephone, mobile and email), these may be the same contact details as those above.

- If you have previously completed a Self Assessment return, you should also advise HMRC of your previous ten-digit Unique Taxpayer Reference number. This tax reference will appear on letters and forms sent to you by HMRC about your tax return.

- The date your circumstances changed.

When does a Self Assessment tax return need to be completed by?

31st October (midnight) - Deadline for those filing a paper self assessment return.

31st January (midnight) - Deadline for those filing a paper self assessment online.

Key Self Assessment Tax Information and Statistics

In 2013, 730,000 taxpayers missed the deadline for filing self-assessment tax returns compared to 850,000 in 2012.

Failing to complete self assessment (whether deliberately or accidently) incurs in a fine of £100.00

Approximately 10.3 Million tax payers completed self assessment tax returns in 2013 of which:

- 82% of tax payers electronic - 9.6 Million tax payers filed their self assessment tax returns online

- 18% of Tax Payers paper - 0.7 Million tax payers filed their self assessment tax return in the traditional tax form document

I don't qualify for Self Assessment how do I claim back personal expenses?

Don't panic, there are several allowances which you can claim to reduce your tax bill without completing a Self assessment tax form. HMRC form P87 (Tax Relief for Expenses of Employment) is for employees to tell HMRC about the expenses incurred that you want to ask for relief on. In some circumstances you can simply call your local HMRC office. The following list provides details on the types of legitimate tax expenses for which you can claim tax relief.

The information below is provided directly from HMRC website and outlines ares in which you may be liable for tax relief. Links open in a new window for further reading on HMRC's website.

Business mileage or fuel

You may be able to get tax relief for business mileage when you use your own vehicle on business, or for fuel you buy when you use a company car. You can't claim, though, for your normal commuting costs.

Find out about getting tax relief for business mileage or fuel

Professional fees and subscriptions

You can ask for tax relief for the cost of fees and subscriptions you pay to some approved organisations - but only if you have to pay them, or if it's helpful for your work.

Get information about tax relief for professional fees and subscriptions

Tools and specialist clothing

If you have to provide small tools or buy specialist clothing for your work - like a uniform or protective clothing - you may be able to get tax relief for the cost of them.

Find out about tax relief for specialist tools or clothing

Capital allowances

If you buy something like a filing cabinet or a desk for your work - called capital expenditure - you might be able to get capital allowances to help with the cost.

Find out about claiming tax relief for capital expenditure

Household expenses when working at home

You may be able to get relief for some household expenses and some travelling costs if you work from home. You might also be able to get capital allowances for capital expenditure.

Get details of tax relief for household expenses when working at home

Travel and subsistence costs

You may be able to get relief for the cost of business travel - for example if you need to visit a client or go to a temporary workplace. You can also ask for relief for 'subsistence' - the cost of meals and overnight expenses.

Find out about tax relief for travel expenses and subsistence costs

If you like this tax article..

If you like this tax article, please dont forget to share a link to use of your favourite social network. We also recommend the following tax articles.